The market situation in the labeling industry remains tight.

The first quarter of 2022 picked up where the last quarter of 2021 left off – restrictions in the delivery chain, material shortage, spiraling energy- and raw material prices and now the aggressive war in the middle of Europe also.

The market situation of our labeling industry remains very tight and we recognize it as fundamentally important to inform you about it continuously and openly.

The completed calendar year has brought to our company the never known before price adjustments, which we tried to compensate for several months, but finally had to pass them on because the pressure emerged hereby became existence-threatening. Currently we can report weekly about new and re-increasing purchasing prices, which is why we cannot foresee the end, not to speak of a turning trend for our selling prices.

In our opinion, the delivery capability as well as plannability of our customers are of highest priority, for that reason we would like to keep on providing information to backgrounds and effects, but especially recommendations for action to solve or to bridge the current situation.

Backgrounds:

A strike in important paper factories in Finland has not been settled yet. However, numerous material manufacturers are affected directly with paper materials or indirectly via paper liner. The Finnish paper factories usually cover a not insignificant share of the European need; that is why the impact will be classified as significant. (You can find further information here: https://www.euwid-verpackung.de/news/unternehmen/streik-in-den-finnischen-papierfabriken-von-upm-verlaengert-sich-weiter-bis-ende-april-010422/)

The effects of corona pandemic are also still clearly noticeable. In the past calendar year these effects slowed down the overall German industry due to the shortage of input factors, this means raw materials and preliminary products. Due to multiple worldwide lockdowns not only the manufacturing of preliminary products, but also all delivery chains have come out of sync, which results in a general shortage of raw materials. This effect will be potentiated by the war in Ukraine in the spring of 2022, because this war not only negatively affects further delivery chains, but is also accompanied by a significant increase of energy costs as well as transportation shortage, because the inner-European market lacks approx. 1 million drivers from Ukraine. You can find further information here: https://www.destatis.de/DE/Methoden/WISTA-Wirtschaft-und-Statistik/2022/01/lieferengpaesse-012022.pdf?__blob=publicationFile

Effects:

In first place, the presented challenges have an impact on the existing offer of preliminary products and raw materials, which is far smaller than the current worldwide demand. By that on the one hand dramatic delivery times have been established, and on the other hand resulted in permanently increasing prices. The average delivery time for films is 18 weeks, for papers 20 weeks. The paper prices rose within the last 12 months by 60 % and films during the same period of time by round 50%. Additionally, there are permanently increasing energy- and transportation costs. We expect this trend to continue in the coming months as well.

Measures:

Numerous measures have already been implemented in last 10 months. These include:

- the price stability until June 2021, with the raw material prices having already sharply risen previously,

- the increase of our stock inventory in the area of finished goods at own risk

- the increase of our stock inventory in area raw materials at own risk

- the active inventory notification to our framework agreement customers

- the increase of order quantities to receive better purchasing conditions

- the joining of purchasing cooperative

- the introduction of alternative materials to avoid line stoppages

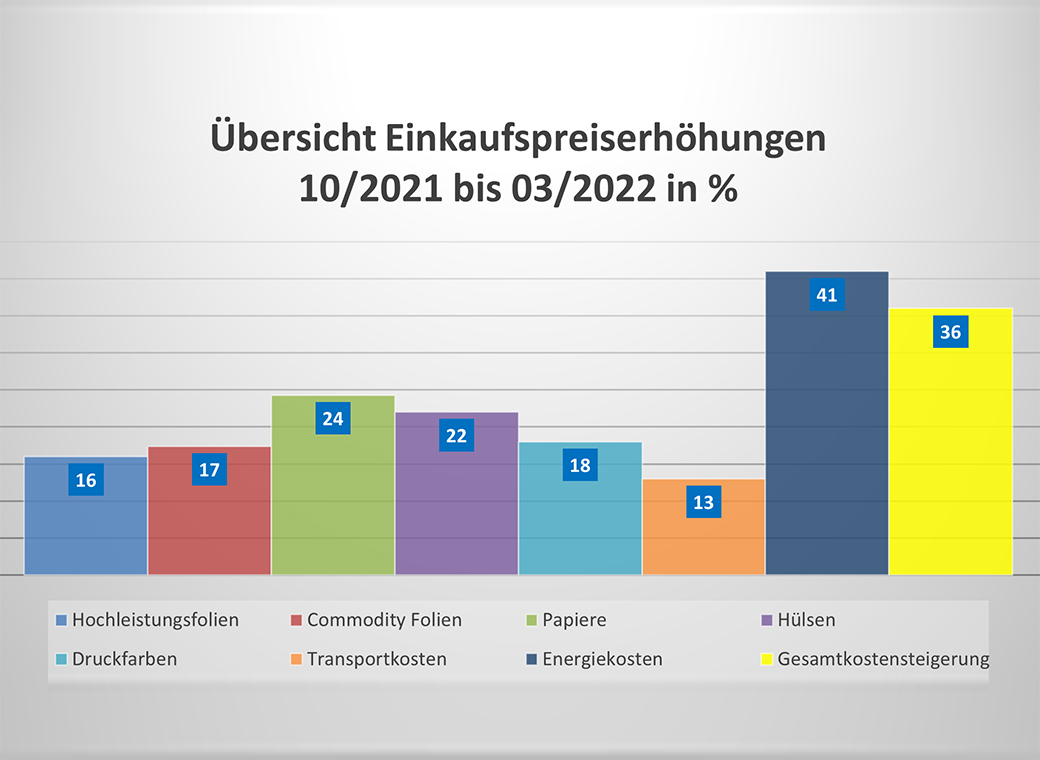

Despite all these measures our purchasing department recorded an overall inflation rate of 36% in the last half year, which is why we have to forward this market price development in future as well. We will contact you soon in regard to the inevitable price spiraling.

Recommendation:

To ensure our continuous capability to deliver, we recommend a close and permanent exchange similar to the previous months. Our stocks are still well filled due to the measures mentioned above. Still, the delivery time by pre-suppliers will be permanently corrected and prolonged. Hence we ask you to plan far ahead and to check your own stocks regularly if applicable. Many customers swapped from single orders to framework agreements during last months, which significantly simplifies the plannability for us. In general, we must expect increasing prices and especially delivery times.

Delivery time:

Our delivery time extremely depends on the availability of materials. Due to over 500 different materials in stock we often can find and deliver an alternative solution at short notice. Hence you can contact us at any time with acute requests and orders, which we will check at short notice.

In the area of standard film labels our delivery time for materials not in stock is at least 18 weeks. For materials and components in stock approx. 2-3 weeks. For paper labels we must calculate at least 2 more weeks accordingly.

Special films with special adhesives have currently a delivery time of at least 20 weeks.

We are aware that this situation is an extraordinary test for endurance for you as well. However, we can ensure you that we as a medium-sized company will do everything possible to maintain your capability to deliver and to remain your reliable partner.

We would like to thank you for your trust so far and we are sure that together with you we will get through this challenging times!

Daniel Sugg & Simon Reuter

Managing partners